МНЕНИЕ РЕДАКЦИИ

Российский стартап-рынок в первый месяц осени 2013 года показал выраженный рост – активность игроков, представляющих ИКТ-проекты, выразилась почти в двухкратном увеличении количества сделок и усилению роли предпосевных инвесторов в наблюдаемых RusBase нишах. Ранее непопулярные для «ранних пташек» сектора электронной коммерции, в том числе и мобильной, и технологические проекты в области софта стали получать инвестиции до 500 тыс долларов. Этот тренд является отголоском «бушующей» с 2007 года на Западе моды на мобильные решения, которые можно запускать на рынок быстро и недорого. Для этих целей во всем мире строятся акселераторы и инкубаторы по образу и подобию YCombinator, 500Startups и TechStars и в очередной раз за все время существования рынка похожую модель в сентябре 2013 года применили в Россию руководители ФРИИ. В этом смысле увеличение предпосевных и посевных инвестиций может произвести эффект либерализации стартап-индустрии, которая сегодня слишком сильно зависит от крупных стратегических и нетехнологических игроков и государства.

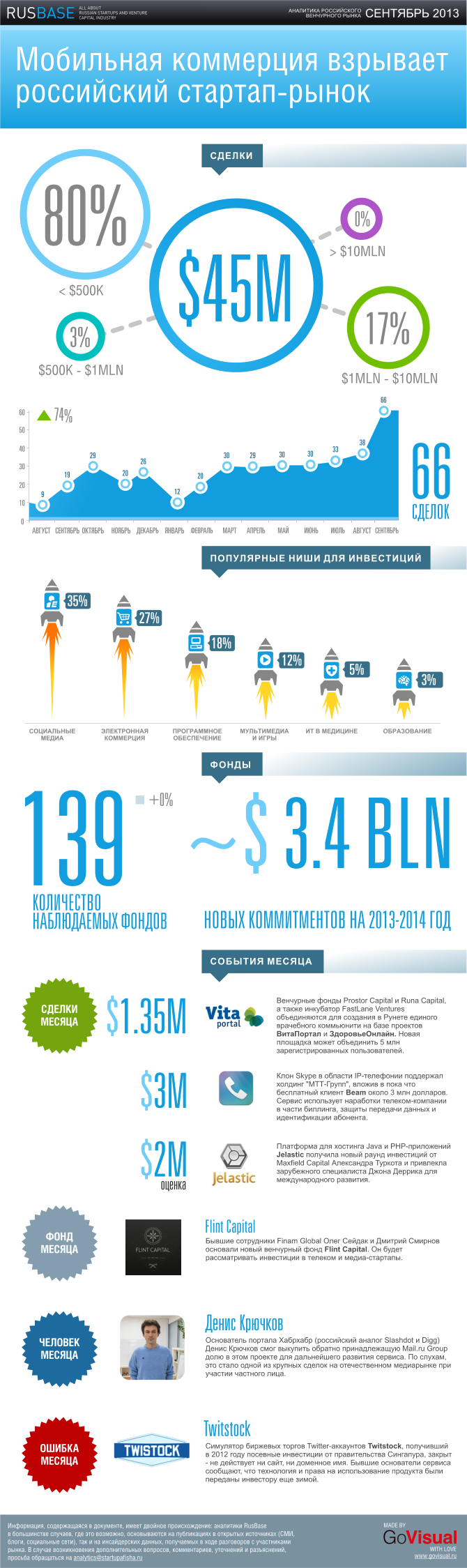

Аналитика российского венчурного рынка за сентябрь 2013 года отображена в инфографике, любезно предоставленной нам компанией GoVisual

СДЕЛКИ МЕСЯЦА

Сумма: 1,35 млн долларов

Инвесторы: Prostor Capital, Runa Capital, FastLane Ventures

Комментарий RusBase: Одни из топовых игроков российской венчурной индустрии – фонды Runa Capital, Prostor Capital и Fastlane Ventures в сентябре 2013 года начали сделку по объединению своих активов в области интернет-медицины для создания нового портала. Основной компанией станет ВитаПортал (актив FLV и Prostor Capital), к которой будет присоединен «ЗдоровьеОнлайн», поддерживаемый Runa Capital. В рамках слияния компаний в объединенный ВитаПортал будут проинвестировано дополнительно 1,35 млн долларов со стороны основателя “ЗдоровьяОнлайн” и RunaCapital. Итогом сделки должна стать медиаплощадка, которая объединит аудиторию в 5 млн человек, которые ищут информацию о здравоохранении в Сети.

Сумма: 3 млн долларов

Инвесторы: МТТ-Групп

Комментарий RusBase: МТТ-Инновации, входящая в холдинг МТТ-Групп, владеющий телеком-оператором МТТ (входит в топ-10 крупнейших телеком-активов России), проинвестировали разработку клиента Beam для IP-телефонии. Приложение для мобильных устройств должно составить конкуренцию VoIP-решениям, в частности Skype, за счет технологических преимуществ и рыночных возможностей МТТ-Групп во всем мире в части приземления голосового трафика.

Сумма: 2 млн долларов (предположение)

Инвесторы: Maxfield Capital

Комментарий RusBase: Фонд экс-директора ИТ-кластера «Сколково» Александра Туркота Maxfield Capital проинвестировал в резидента «Сколково» Jelastic, разрабатывающего облачную платформу для хостинга Java/PHP-приложений. Проект до этого смог привлечь около 4 млн от российских инвесторов.

ФОНД МЕСЯЦА

Комментарий RusBase: Основанный после ухода из Финам Глобал его топ-менеджеров – Дмитрия Смирнова и Олега Сейдака, венчурный фонд Flint Capital стал новым игроком на российском венчурном рынке. В фокусе внимания инвесторов – телеком и медиапроекты.

ЧЕЛОВЕК МЕСЯЦА

Комментарий RusBase: Российский технологический предприниматель Денис Крючков, начинавший как журналист «Вебпланеты», позже основавший ИТ-проект Хабрахабр и медиакомпанию «Тематические медиа», в сентябре 2013 года завершил сделку по обратному выкупу своей доли в Habrahabr.ru у Mail.ru Group. Пикантность истории состоит в том, что финансирование в размере 10 млн долларов Крючков получил у заклятого конкурента Mail.ru Group Яндекса.

ОШИБКА МЕСЯЦА

Twitstock

Комментарий RusBase: Переданный безвозмездно инвестору еще зимой 2012/2013 года симулятор торгов Twitter-аккаунтами сервис Twitstock был закрыт в сентябре 2013 года. Один из его основателей – Алексей Гиязов отмечает, что работы над проектом стопорились из-за разногласий с инвестиционной командой, несмотря на то, что сама технология была создана.

ОБРАЩАЕМ ВАШЕ ВНИМАНИЕ

Информация, содержащаяся в документе, имеет двойное происхождение: аналитики RusBase в большинстве случаев, где это возможно, основываются на публикациях в открытых источниках (СМИ, блоги, социальные сети), так и на инсайдерские данные, получаемые в ходе разговоров с участниками рынка. Инсайды относятся прежде всего к суммам инвестиций и к самим фактам сделок – по этой причине итоговое количество сделок на рынке за месяц включает как известные в СМИ факты, так и неизвестные (так называемые, «скрытые» сделки).

Аналитические данные (включая информацию из открытых источников) предоставляются по принципу «как есть» и не могут являться единственной и безальтернативной основой для принятия инвестиционных решений, осуществления сделок и решения иных задач без дополнительной верификации у владельцев упоминаемых бизнесов или управляющих. Верифицированные данные доступны в платных отчетах, подготавливаемых по заказу клиента – ссылка на раздел.

В случае возникновения дополнительных вопросов, комментариев, уточнений и разъяснений, просьба обращаться на [email protected]

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?

ВОЗМОЖНОСТИ

10 мая 2024

13 мая 2024