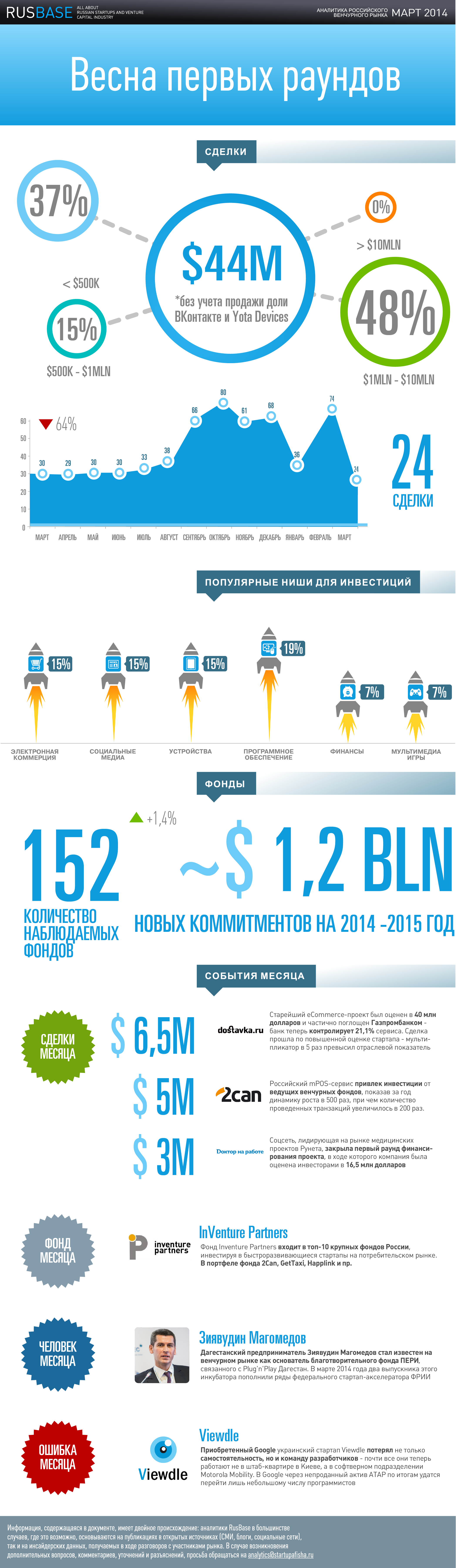

Первый месяц весны 2014 года принес достаточно серьезные изменения на венчурном рынке России для популярных проектов в области медиа, электронной коммерции и разработки ПО. Впервые за долгое время на рынке начало уменьшаться количество сделок на ранней стадии, а увеличиваться — количество сделок первого раунда (когда стартап получает поддержку фондов под рыночную оценку, связанную с конкретными показателями его бизнеса).

Фактически это означает, что инвесторы нашли и вложили деньги в быстрорастущие проекты (поскольку еще не так давно рынок разогревался предпосевными инвестициями). Из новых категорий, которые стали популярны в марте 2014 года, можно отметить устройства — инвесторы собирают венчурные фонды для поддержки создателей аппаратного обеспечения и гаджетов.

СДЕЛКИ МЕСЯЦА

6,5 млн долларов

Газпромбанк

Газпромбанк приобрел 21,1% интернет-магазина Dostavka.ru — старейшего eCommerce-проекта России, оценив postmoney всей компании в $40 млн. Бенефициаром сделки называется Сергей Калугин, президент «Ростелекома» и один из бывших совладельцев холдинга WebMediaGroup, в которую входила Dostavka.ru. Сейчас, как говорят источники, близкие к сделке, у Калугина нет акций в WebMediaGroup.

В минувшем году оборот Dostavka.ru вырос на 27% и составил около 1,5 млрд рублей со средним чеком 10,5 тыс рублей, но несмотря на это, Dostavka.ru получила высокую оценку «Газпромбанка» (1 годовой оборот), поскольку аналогичные интернет-магазины приобретаются по мультипликатору 0,2-0,4 оборота.

5 млн долларов

Inventure Partners, Almaz Capital, группа ЕСН

5 млн долларов собрала 2Can на развитие своего бизнеса от ведущих венчурных фондов России, инвестирующих в финансовые стартапы. Привлеченные средства будут направлены на увеличение доли рынка 2can под собственным брендом, интеграцию с ведущими банками страны в рамках направления White label и дальнейшее техническое развитие сервиса. В планах — запуск кастомизированных платежных решений для других приоритетных сегментов, внедрение новых функций, расширение партнерства с банками и платежными сервисами, продолжение активного набора клиентской базы. За последний год оборот сервиса вырос в 500 раз, а количество проведенных транзакций увеличилось в 200 раз.

3 млн долларов

Bright Capital, Guard Capital, Aurora Venture Capital

Российский отраслевой медиапроект «Доктор на работе» получил финансирование в размере 3 млн долларов от трех фондов, выкупивших миноритарные доли бизнес-ангелов, первыми вложивших в этот проект. На это была израсходована меньшая часть финансовых вливаний. Это раунд А финансирования проекта, в ходе которого компания была оценена инвесторами в $16,5 млн.

ФОНД МЕСЯЦА

Фонд Inventure Partners входит в топ-10 крупных фондов России, инвестируя в быстроразвивающиеся стартапы на потребительском рынке. В портфеле фонда — 2Can, GetTaxi, Happlink и пр. Недавно фонд предпринял исследование ниш для инвестирования в мире, оценив наиболее популярные из них с точки зрения мультипликаторов на вложения, что вызвало активное обсуждение в сообществе.

ЧЕЛОВЕК МЕСЯЦА

Дагестанский предприниматель Зиявудин Магомедов стал известен на венчурном рынке как основатель благотворительного фонда ПЕРИ, связанного с Plug'n'Play Дагестан. В марте 2014 года два выпускника этого инкубатора пополнили ряды федерального стартап-акселератора ФРИИ, получив от ПЕРИ по 20 тыс долларов предпосевных денег.

ОШИБКА МЕСЯЦА

Приобретенный Google украинский стартап Viewdle потерял не только самостоятельность, но и команду разработчиков. Как сообщают источники на украинском рынке, теперь все они работают не в штаб-квартире компани в Киеве, а в софтверном подразделении Motorola Mobility, которое было продано Lenovo. Украинский офис Viewdle закрыт и 20 программистов фактически «зависли» в США. В Google через непроданный в сделке с Lenovo актив Motorola ATAP group (Advanced Technology and Projects group) удаcтся перейти лишь небольшому числу программистов.

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?