Михаил Курчатов

ОБРАЩАЕМ ВАШЕ ВНИМАНИЕ

РЕЗЮМЕ

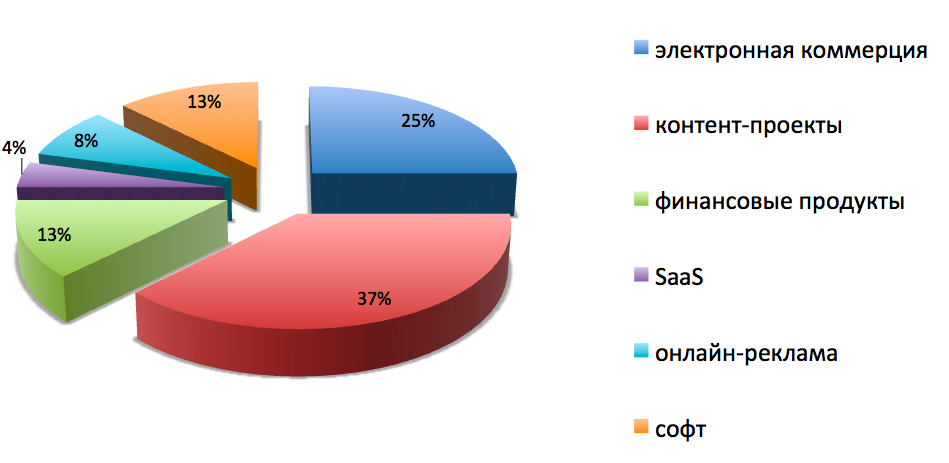

Октябрь 2012 года принес резкий рост количества сделок в контент-проектах – российские и западные инвесторы практически ежедневно объявляли о том, что входят в проекты, занимающиеся хранением медиаконтента, строительством тематических соцсетей и порталов, сбором и обработкой информации для представления для разных аудиторий пользователей – от детей и их родителей до профильных инвесторов мирового уровня, а также смежными областями. Тем не менее, большая часть средств инвесторов осталась за проектами в сфере электронной коммерции, как наиболее понятной по бизнес-стратегии области: в этом отношении уровень развития рынка можно определять как экстенсивный и далеко не прогрессивный (больше половины от привлеченных денег приходится на уже устоявшиеся проекты, которые готовятся к IPO или вышли на финишную прямую по продаже профильному инвестору). Вместе с тем, российские инвесторы активно приобретают западные проекты третьего и четвертого эшелонов, держа в уме возможности синергии их со своими бизнесами и создавая локальные истории успеха.

| СДЕЛКА МЕСЯЦА |

|

|

В октябре 2012 года самой крупной сделкой на рынке венчурных инвестиций в России стал выкуп дополнительных акций интернет-магазина KupiVIP.ru польской инвест-компанией MCI Management (управляет венчурными фондами MCI.TechVentures, Internet Ventures, MCI.EuroVentures, Helix Ventures Partners) Общая сумма допэмиссии составила около 15,5 млн долларов, а суммарный объем внешних вливаний в одну из лидирующих на отечественном рынке электронной коммерции компаний превысил 140 млн долларов. |

|

Привлеченные инвестиции компания намерена потратить на развитие своих ключевых проектов - шопинг-клубов KupiVIP.ru и KupiLUXE.ru, интернет-магазина ShopTime.ru, а также на производство товаров под собственными брендами. Иные детали сделки неизвестны, равно как и доля выкупленных акций, однако очевидно, что холдинг также может задействовать полученные средства на поглощение других стартапов на рынке в канун своего IPO на NYSE, ожидаемого до 2014 года. Кроме того, основатель KupiVIP.ru Оскар Хартманн имеет мечты по расширению интернет-бизнеса своего детища в России за счет лоббирования интересов по снижению до нуля таможенных пошлин для ритейлеров. |

ФОНД МЕСЯЦА |

|

|

Бизнес-ангел Игорь Мацанюк, известный как один из самых активных венчурных инвесторов в России, получил поддержку со стороны своих экс-коллег по Mail.ru Михаила Винчеля и Грегори Фингера по созданию венчурного фонда IMI.VC. Они Винчель непосредственно вложил 75 млн долларов в данный проект, а Фингер стал членом совета директоров. Появившиеся на счетах IMI.VC денежные средства пойдут на развитие проектов, в которые Игорь Мацанюк инвестировал ранее – наиболее близкими кандидатами являются разработчик мобильных игр GameInsight и ее спинофф – студия комиксов NARR8, а также некоторые из команд из Академии стартапов Farminers (состав и количество которых постоянно меняется и насчитывает от 13 до 20 проектов). Помимо прочего, Мацанюк не исключает возможности соинвестирования в вышеуказанные и другие проекты при поддержке партнеров Винчеля и Фингера из двух других венчурных фондов – iTech Capital и Buran VC. По информации «СтартапАфиши», для этих целей размер подписки фонда IMI.VC может быть увеличен вдвое – до 150 млн долларов, где большую часть составят средства именно партнеров Мацанюка |

СТАРТАП МЕСЯЦА |

|

|

Стартапом месяца в октябре 2012 года признается туристический онлайн-сервис OneTwoTrip. Он получил 16 млн долларов от венчурной компании Atomico, которая известна тем, что среди ее основателей есть соучредитель Skype Никлас Зеннстром. OneTwoTrip, основанная Петром Кутисом, выходцем из аналогичного стартапа Anywayday, в мае 2011 года, за полтора года вышла на уже второй раунд инвестиций – первые крупные фондовые деньги она привлекла в начале сентября 2012 года в размере $9 млн от фонда Phenomen Ventures. Ежемесячный оборот OneTwoTrip, по собственным оценкам компании, в июне 2012 года составил $30 млн, а по итогам года этот показатель может составить $400 млн. У сервиса сейчас 20 тысяч уникальных посетителей в сутки, ежедневно выписывается более 3,5 тыс. билетов, с каждого из которых сайт оставляет комиссию в размере 6-7%, что и приносит основную выручку в проекте, однако показатель прибыли компания не раскрывает. Западные эксперты уверены, что российский туристический сегмент интернет-рынка растет высокими темпами и сохранит такую динамику еще долго – так, объемы онлайн-продаж авиабилетов в этом году достигнут $3-4 млрд, соответственно, OneTwoTrip может занят 10% этого рынка. |

ЧЕЛОВЕК МЕСЯЦА |

|

|

Гражданин Сингапура Сергей Белоусов, основатель международного венчурного фонда Runa Capital и партнер фонда Almaz Capital, чье личное состояние оценивается в более чем 500 млн долларов, стал человеком октября 2012 года на венчурном рынке России. Ему присуждена премия в области менеджмента “АРИСТОС-2012” в номинации “Лучший венчурный инвестор”. Решающим фактором в появлении новой номинации в истории одной из самых престижных премий отечественного бизнеса стал значительный рост инвестиционной активности в сегменте венчурного финансирования. Новая номинация была учреждена по инициативе РВК с целью создания механизма общественного признания успехов и дальнейшего стимулирования развития венчурной отрасли и была поддержана учредителем премии «АРИСТОС» — Ассоциацией Менеджеров. |

ОБЪЕМ ОБЪЯВЛЕННЫХ ЗА МЕСЯЦ СДЕЛОК И ДИНАМИКА |

|

| В октябре 2012 года на российском венчурном рынке было проведено сделок на общую сумму около 125 млн долларов, что на треть меньше, чем в сентябре 2012 года (тогда было более 190 млн долларов). Учитываются публичные сделки, данные о которых, были размещены в каких-либо информационных источниках, а также закрытые сделки с неразглашенными данными (оценка произведена аналитиками «СтартапАфиши»). Максимальная сумма одной сделки по инвестированию составила около 50 млн $ (продажа 50% доли Sotmarket.ru). Минимальная сумма инвестиций составила 120 000 $ (инвестиции Moscow Seed Fund в разработчика сервиса LikeHack). | |

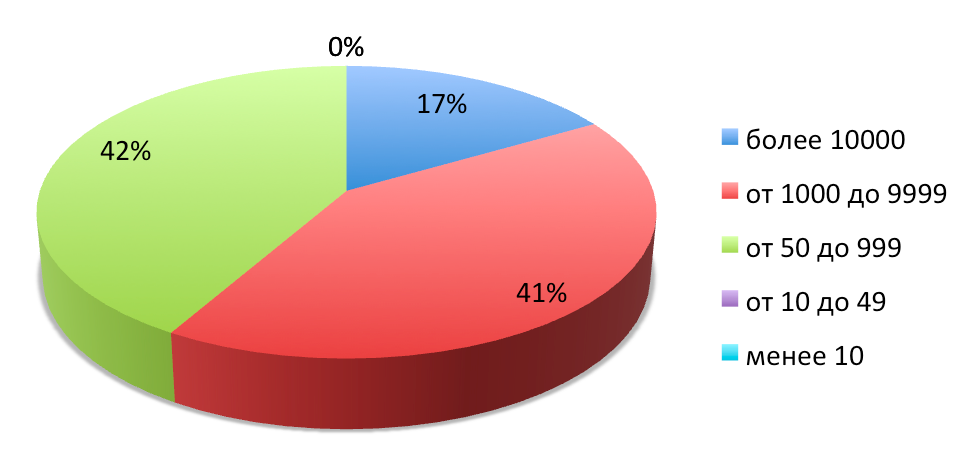

| Количество сделок по сумме, тыс долл | |

|

|

КОЛИЧЕСТВО СДЕЛОК ЗА МЕСЯЦ И ДИНАМИКА |

|

|

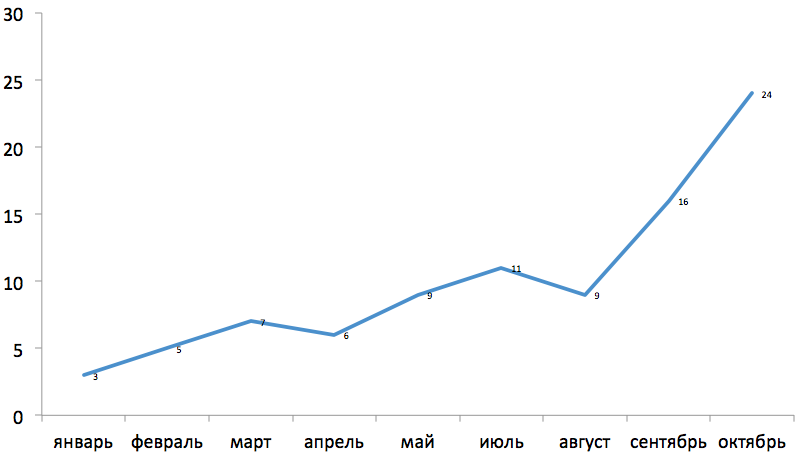

В сентябре 2012 года на российском венчурном рынке произошло 24 сделки, что на 8 сделок больше (33% рост), чем в сентябре 2012 года. Динамика роста сделок |

|

|

|

ОБЪЕМ НОВЫХ КОММИТМЕНТОВ ФОНДОВ И ДИНАМИКА |

|

| В октябре 2012 года работающие на российском венчурном рынке фонды объявили о готовности вложить суммарно около 100 млн долларов в российские проекты на ближайшие полгода. | |

|

КОЛИЧЕСТВО НАБЛЮДАЕМЫХ НА РЫНКЕ ФОНДОВ |

|

| В октябре 2012 года на российском венчурном рынке действовало 109 фондов (УК, инкубатор, акселлератор, инвест-компания), занятых венчурным инвестированием, что на 4 фонда больше (рост 3,6%), чем в сентябре 2012 года | |

|

РАСПРЕДЕЛЕНИЕ СТАРТАПОВ ПО ТЕХНОЛОГИЯМ |

|

| В октябре 2012 года инвестиции в стартапы распределились по нишам следующим образом | |

|

|

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?

ВОЗМОЖНОСТИ

25 апреля 2024

26 апреля 2024

29 апреля 2024