МНЕНИЕ РЕДАКЦИИ

Май 2013 года продолжил укоренившийся тренд рынка венчурного бизнеса, состоящий в преобладании сделок с медиапроектами и интернет-стартапами, занимающимися маркетингом и поиском. Почти все такие стартапы получали финансирование в пределах 300-500 тыс долларов, что соответствует примерно 3-4 месяцам активной работы на стадии роста. Заинтересованность инвесторов такими разработками можно объяснить продолжающимся ростом электронной коммерции и соцмедиа, которые пользуются или используются интернет-маркетологами.

Май-месяц также стал месяцем разочарований для разработчиков ПО – их продукты были наименее востребованы и остаются маргинальным направлением на российском венчурном рынке. Наконец, в мае же продолжилась «черная полоса» для проектов в области путешествий – эти бизнесы продолжили закрываться.

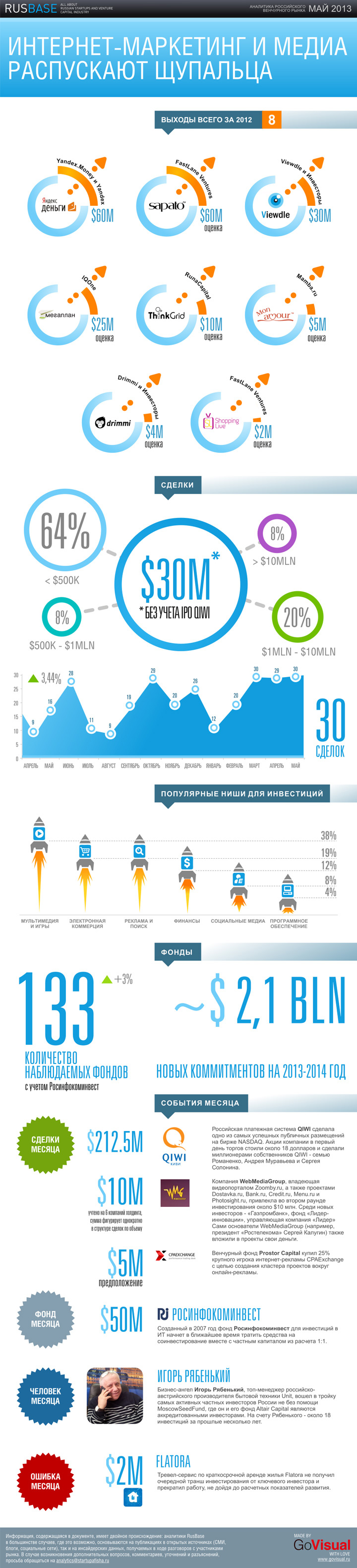

ПРО EXITS 2012

В 2012 году на российском (включая Беларусь, Украину и Казахстан) рынке венчурных инвестиций произошло не менее 8 крупных сделок, причисляемых отделом аналитики Rusbase к "выходам" (это продажи стартапов стратегическим инвесторам, поглощения и слияния, покупки команд и покупки продуктов). Мы исключаем из списка сделку "Бегун" - "Рамблер" как несоответствующую по формальным признакам "венчуру", а также несколько мелких сделок, в том числе и с безденежным поглощением и экстерриториальным объектом (когда российский инвестор покупает иностранный актив).

Аналитика российского венчурного рынка за май 2013 года отображена в инфографике, любезно предоставленной нам компанией GoVisual.

СДЕЛКИ МЕСЯЦА

$ 212,5 mln

Инвестор: публичное размещение акций на NASDAQ

Комментарий RusBase: российская платежная система QIWI провела успешное IPO в США, будучи оцененной в 844 млн долларов. Акционеры реализовали 12,5 млн акций (23% от общего количества акций компании), цена одной акции в ходе размещения равнялась $17 в рамках ранее установленного коридора $16-18 за одну акцию. В списке крупнейших акционеров QIWI значатся Mail.ru Group, размывшая свою долю с 21,4% до 19,8%, семья Андрея и Николая Романенко - с 12,7% до 9,3%, а также основатель «Сибирского цемента» Андрей Муравьев - с 8,5% до 6,2%. Помимо этого в акционерном капитале фигурируют основатели QIWI-Банка, компания Mitsumi, а также представитель интересов платежной системы e-Port (ОСМП) – компания E1.

$ 10 mln

Комментарий RusBase: Холдинг WebMediaGroup, владеющий 6 интернет-проектами - видеопорталом Zoomby.ru, а также сервисами Dostavka.ru, Bank.ru, Credit.ru, Menu.ru и Photosight.ru, привлек при участии венчурных фондов 10 млн долларов. Примечательность сделки состоит в том, что в раунде участвовал фонд «Лидер-инновации», учрежденный ОАО «РВК», совместно с «Газпромбанком» и менеджментом компании. Стороны не раскрывают разделение финансов по портфельным компаниям, но известно, что большую часть денег получил проект Zoomby.ru. Основатели холдинга по-прежнему держать контрольный пакет, в том числе порядка 25% – у Сергея Калугина, у «Газпромбанка» и фонда «Лидер-инновации» – совокупно порядка 30%

$ 5 mln (оценка)

Комментарий RusBase: интернет-биржа рекламы CPAExchange, размещающая объявления по модели «оплата за действиие» (cost per action) совместно с технологией RTB («ставки в режиме реального времени»), привлекла предположительно около 5 млн долларов от венчурного фонда Prostor Capital в обмен на 25% акций. Основная цель инвестиций в CPAExchange – формирование кластера в сегменте онлайн-рекламы, который фонд рассматривает как один из стратегически приоритетных. Сам же стартап планирует занять 20% рынка в России в перспективе следующих двух лет.

ФОНД МЕСЯЦА

Комментарий RusBase:

ОАО «Российский инвестиционный фонд информационно-коммуникационных технологий» (Росинфокоминвест), который был создан в 2007 году под инвестиции в ИТ-проекты, переформатировал свою стратегию и будет поддерживать инициативы ГЧП (государственно-частных партнерств), вкладывая средства в отношении 1:1 вместе с частными соинвесторами в отобранные ими стартапы. Уставный капитал фонда сформирован из средств федерального бюджета и составляет 1,45 миллиарда рублей. Управление средствами фонда осуществляется ЗАО «Лидер». Срок деятельности фонда, направленной на финансирование перспективных ИТ-проектов на начальном этапе реализации, установлен до 1 января 2018 года, предельный размер инвестиций в один инвестпроект — 150 миллионов рублей.

ЧЕЛОВЕК МЕСЯЦА

Комментарий RusBase: российско-австрийский предприниматель украинского происхождения, входящий в топ-5 самых активных бизнес-ангелов отечественного венчурного рынка. На счету Игоря Рябенького – более 18 инвестиций в стартапы на ранней стадии и еще около 10-12 сделок в рамках созданного им венчурного фонда Altair Capital Management. Инвестор является партнером бизнес-инкубатора МГУ, аккредитованным инвестором (как ангел, так и как фонд) Moscow SeedFund, а также членом наблюдательных советов нескольких конкурсов стартапов.

ОШИБКА МЕСЯЦА

Комментарий RusBase: Сервис краткосрочной аренды жилья Flatora объявил о своем закрытии в мае-месяце 2013 года. Компания, по словам ее владельцев, столкнулась с проблемами на стороне инвестора, не пожелавшего продолжать финансирование бизнеса из-за недостижения сервисом определенных показателей.

ОБРАЩАЕМ ВАШЕ ВНИМАНИЕ

Информация, содержащаяся в документе, имеет двойное происхождение: аналитики RusBase в большинстве случаев, где это возможно, основываются на публикациях в открытых источниках (СМИ, блоги, социальные сети), так и на инсайдерские данные, получаемые в ходе разговоров с участниками рынка. Инсайды относятся прежде всего к суммам инвестиций и к самим фактам сделок – по этой причине итоговое количество сделок на рынке за месяц включает как известные в СМИ факты, так и неизвестные (так называемые, «скрытые» сделки).

Аналитические данные (включая информацию из открытых источников) предоставляются по принципу «как есть» и не могут являться единственной и безальтернативной основой для принятия инвестиционных решений, осуществления сделок и решения иных задач без дополнительной верификации у владельцев упоминаемых бизнесов или управляющих. Верифицированные данные доступны в платных отчетах, подготавливаемых по заказу клиента – ссылка на раздел.

В случае возникновения дополнительных вопросов, комментариев, уточнений и разъяснений, просьба обращаться на [email protected]

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?

ВОЗМОЖНОСТИ

20 апреля 2024

21 апреля 2024

21 апреля 2024