МНЕНИЕ РЕДАКЦИИ

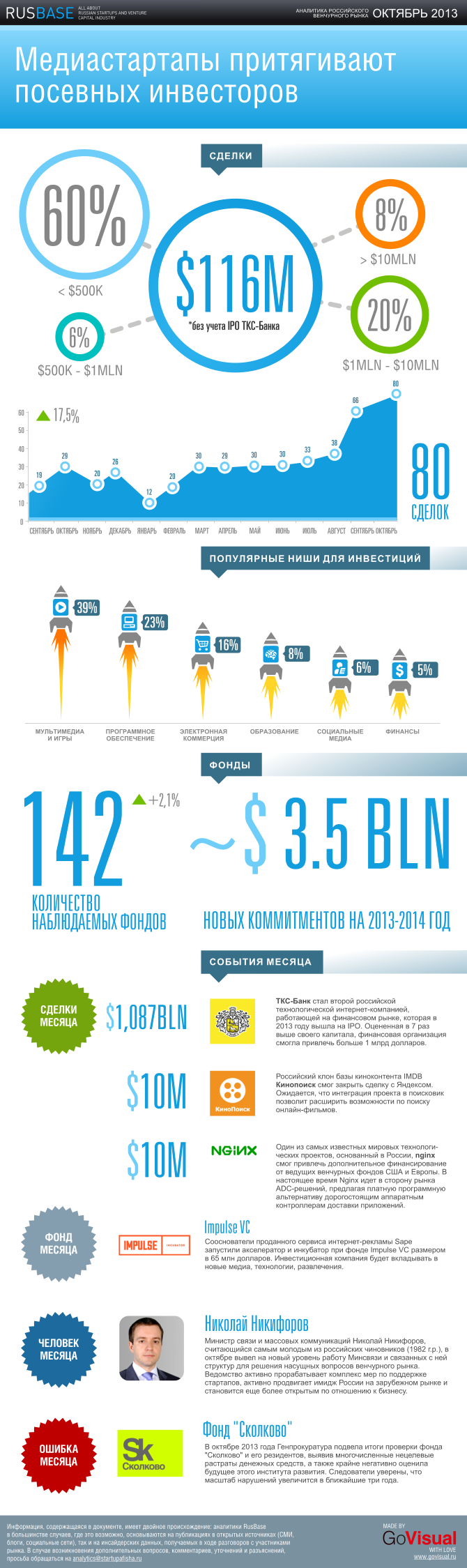

Октябрь 2013 года, закрывающий третий квартал года, продолжил начатую летом тенденцию преобладания посевных инвестиций на рынке. В октябре наибольшее число сделок такого объема произошло на рынке медиастартапов. Очевидно, что это связано с приближением зимы, по окончании которой на российском медиарынке происходит процесс распределения рекламных бюджетов. По этой логике большая часть СМИ, соцсетей и инфопроектов создается в октябре-декабре и за несколько месяцев строит продукт, для которого в феврале-марте привлекаются рекламодатели.

Самой быстрорастущей нишей на рынке за октябрь-месяц стала ниша ПО и разработки. Не в последнюю очередь это связано с большим количеством стартап-мероприятий в формате хакатонов летом в России, а также с деятельностью ФРИИ, взявшего на программу акселерации с элементами инкубации достаточно много проектов.

Под конец года усилилась и конкурентная борьба между фондами за проекты – начинающие набирать силу синдицированные сделки практически отсутствовали. Инвесторы начали вкладывать в проекты на опережение и в итоге на рынке есть несколько сделок в проекты, которые имели коммитменты от разных фондов.

Аналитика российского венчурного рынка за октябрь 2013 года отображена в инфографике, любезно предоставленной нам компанией GoVisual

СДЕЛКИ МЕСЯЦА

Тинькофф Кредитные Системы Банк

IPO

1 млрд 87 млн долларов

Размещенная на Лондонской фондовой бирже LSE финансовая интернет-компания Олега Тинькова “ТКС-банк” привлекла больше 1 млрд долларов. Из этой суммы банк получит 175 млн долларов, а остальная сумма будет распределена между акционерами – Олегом Тиньковым, Goldman Sachs Group, Baring Vostok, Vostok Nafta, Horizon Capital и Altruco Trustees Limited. Ажиотажный спрос среди инвесторов позволил оценить проект в 3,2 млрд долларов, что в несколько раз выше стоимости самих активов. Несмотря на то, что на биржу вышел банк, в проспектах для инвесторов Тиньков указывал свой проект как технологический бизнес (фактически копирующий американский Simple.com – прим.RusBase), что и привело к соответствующей высокой оценке акций.

10 млн долларов (оценка)

Крупнейший и старейший российский портал по кинематографу «Кинопоиск» был продан Яндексу в период конца сентября-начала октября по неизвестной стоимости. Известно, что переговоры о покупке данного актива велись и с другими инвесторами, в том числе и западными издательскими домами, однако итогом стало поглощение российским поисковиком. Яндекс планирует встроить инструменты и базу Кинопоиска в свою вертикаль поиска по видеоконтенту и сделать агрегатор онлайн-кинотеатров.

NEA, eVentures, Runa Capital, MSD Capital, Аарон Леви

10 млн долларов

По-прежнему второй по популярности во всем мире веб-сервер, который был создан в 2002-2004 году на досуге одним из разработчиков отечественного поисковика «Рамблер», Nginx привлек финансирование от топовых венчурных фондов США. Сейчас nginx используют сервисы Dropbox, Facebook, Hulu, Instagram, Netflix, Pinterest, Zynga и «Яндекс». В настоящее время nginx идет в сторону рынка ADC-решений, предлагая платную программную альтернативу дорогостоящим аппаратным контроллерам доставки приложений.

ФОНД МЕСЯЦА

Impulse VC (65 млн долларов)

Основатели биржи по обмену ссылками Sape.ru, успешно продавшие свой бизнес структурам Романа Абрамовича (http://www.vedomosti.ru/tech/news/17813961/abramovich-poshel-po-ssylke), запустили на вырученные деньги инвестиционный фонд вместе с инкубатором и акселератором Impulse VC. В фонде уже есть 10 проектов (в один из них – Retail Rocket - инвесторы вошли непосредственно в октябре). Акселератор будет пропускать сквозь себя до 50 проектов в год, предоставляя 25-100 тыс долларов за долю 7-15%, а инкубатор – поддерживать выращенные стартапы, давая 500 тыс долларов за 25-35%.

ЧЕЛОВЕК МЕСЯЦА

Министр связи и массовых коммуникаций Николай Никифоров, считающийся самым молодым из российских чиновников (род. 1982 году), в России является главной персоной по степени своего влияния на развитие рынка ИТ и телекома. За год Минсвязи и связанные с ней структуры активно способствовали сближению российских и иностранных компаний, инвесторов и институтов развития, а также начали работу над изменением законодательства по поддержке стартапов. В октябре ведомство Никифорова организовало несколько международных инвест-мероприятий, а также объявило о начале в скором времени второго Russian Startup Tour.

ОШИБКА МЕСЯЦА

Неизвестно (от 400 млн долларов)

Известный проект по созданию в России аналога американской Кремниевой Долины в формате государственно-частного партнерства (ГЧП) в фонде «Сколково» потерпел почти полное фиаско в 2013 году. Под этим подразумевается тот факт, что большинство ГЧП в сфере инновационного бизнеса теперь воспринимаются как «новые версии» Сколково.

Основная претензия к деятельности фонда «Сколково», управляющей несколькими инвестиционными компаниями внутри фонда, исходила от государства. Генпрокуратура после длительных проверок в конце концов обвинила именно в октябре менеджмент фонда в нецелевом использовании инвестиций и нарушениях в работе. Так, например, в ходе прокурорской проверки были найдены несколько резидентов «Сколково», связанных напрямую со структурами основного инвестора «Сколкова» - Виктора Вексельберга. Эти проекты получили порядка 500 млн рублей грантов. Итог – продолжающиеся проверки правоохранительными органами в фонде, срывы международных контрактов, увольнения и кадровые перестановки в менеджменте, а также серьезный репутационный ущерб стартапам, получавшим финансирование из «Сколково».

ОБРАЩАЕМ ВАШЕ ВНИМАНИЕ

Информация, содержащаяся в документе, имеет двойное происхождение: аналитики RusBase в большинстве случаев, где это возможно, основываются на публикациях в открытых источниках (СМИ, блоги, социальные сети), так и на инсайдерские данные, получаемые в ходе разговоров с участниками рынка. Инсайды относятся прежде всего к суммам инвестиций и к самим фактам сделок – по этой причине итоговое количество сделок на рынке за месяц включает как известные в СМИ факты, так и неизвестные (так называемые, «скрытые» сделки).

Аналитические данные (включая информацию из открытых источников) предоставляются по принципу «как есть» и не могут являться единственной и безальтернативной основой для принятия инвестиционных решений, осуществления сделок и решения иных задач без дополнительной верификации у владельцев упоминаемых бизнесов или управляющих. Верифицированные данные доступны в платных отчетах, подготавливаемых по заказу клиента – ссылка на раздел.

В случае возникновения дополнительных вопросов, комментариев, уточнений и разъяснений, просьба обращаться на [email protected]

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?

ВОЗМОЖНОСТИ

20 апреля 2024

21 апреля 2024

21 апреля 2024