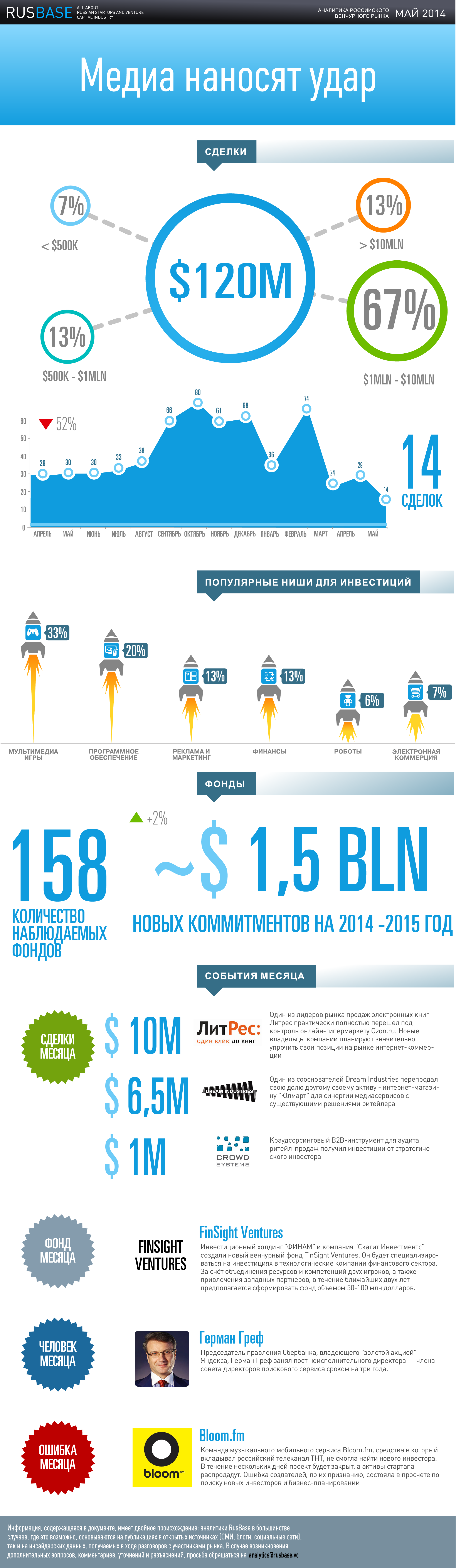

Наличие затяжных праздников, осложнение экономической ситуации и начало проявления эффекта «мягкой» изоляции России от мирового рынка в мае 2014 года влияло на желание инвесторов поддерживать локальные стартапы. В этом месяце наблюдалось снижение количества сделок и преобладание инвесторов «изнутри», которые или увеличивали свои доли в уже проинвестированных проектах, или не являлись фондами (крупные рыночные игроки). Кроме того, российские фонды продолжали играть на международной арене и вкладывать средства в иностранные компании.

Лидером по вложениям в отрасль стала ниша «Мультимедиа/игры», куда попадают проекты, имеющие выраженную бизнес-модель заработка на медиа, а второе место стабильно закрепилось за «Программным обеспечением» — наиболее трендовой нишей, которую поддерживают отечественные и зарубежные венчурные капиталисты. Впервые за все время наблюдений «Электронная коммерция» находится в самом конце как непопулярное направление.

СДЕЛКИ МЕСЯЦА

10 млн долларов

Один из крупнейших и старейших интернет-магазинов России OZON.ru приобрел известного продавца электронных книг «Литрес». Покупке предшествовало обращение и последующее разрешение от ФАС России, поскольку «Литрес» занимает значительную долю (более 75%) рынка. OZON.ru достался контрольный пакет компании, за который было заплачено около 10 млн долларов вместе с покрытием долгов самого магазина. «Литрес» будет интегрирован в холдинг и увеличит товарный ассортимент цифрового контента ритейлера, упрощая ему механизм агрегации. По данным «Литрес», в их базе представлено около 400 000 электронных и 4500 аудиокниг.

6,5 млн долларов

Акционерный конфликт основателей и инвесторов Dream Industries, завершившийся в прошлом месяце, получил логическое завершение в сделке по вхождению «Юлмарт» в капитал Dream Industries. Актив, принадлежащий Дмитрию Костыгину, одному из инвесторов медиахолдинга, вложил в компанию $6,5 млн, а также свои акции. В результате сделки фонд Koshigi вышел из капитала холдинга. Деньги, полученные DI, будут направлены на развитие сервиса Zvooq и Bookmate.

1 млн долларов

B2B-стартапы в области рекомендательных сервисов являются сильно недооцененными ввиду незрелого рынка и недостаточного объема рынка сбыта. Типичная оценка такого проекта — 3-4-кратная годовая выручка с предположительно высоким дисконтом для раннего посевного инвестора (20-30%) — пример такой сделки в мае-месяце демонстировал CrowdSystems, привлекший 1 млн долларов от Inventure Partners на первом раунде.

ФОНД МЕСЯЦА

Инвест-холдинг «Финам» образовал месте с компанией Skagit Investments новый венчурный фонд FinSight Ventures. Он будет специализироваться на инвестициях в технологические компании финансового сектора. За счет объединения ресурсов и компетенций двух игроков, а также привлечения западных партнеров, в течение ближайших двух лет предполагается сформировать фонд объемом 50-100 млн долларов.

Приоритетными сферами для инвестиций FinSight Ventures являются P2P-платформы, платежные системы и различные программные решения для финансового сектора, которые помогают трансформировать его с помощью внедрения новых технологий. География инвестиций не ограничена, но фонд в большей степени ориентирован на Северную Америку, Юго-Восточную Азию и Африку. Предполагается, что в среднесрочной перспективе объем фонда составит 50-100 млн долларов.

ЧЕЛОВЕК МЕСЯЦА

Герман Греф, президент “Сбербанка”, вошел в мае 2014 года в совет директоров Яндекса. По данным “Российской газеты”, переговоры о вхождении Грефа в совет директоров велись с начала текущего года, а на очередном собрании акционеров его кандидатуру поддержало большинство.

Пресс-служба «Яндекса» отмечает, что полномочия Грефа в качестве члена совета директоров начались 21 мая и продлятся до 2017 года. При этом глава Сбербанка будет занимать должность члена совета директоров без исполнительных функций.

Очевидно, что это кадровое назначение связано с тем, что именно Сбербанк является владельцем приоритетной «золотой» акции, выпущенной компанией «Яндекс». Эта акция дает право концентрировать блокирующий пакет акций (свыше 25 процентов) одним лицом или связанной между собой группой лиц.

Кроме того, в декабре 2012 года Сбербанк и «Яндекс» подписали соглашение о создании совместного предприятия на базе сервиса «Яндекс. Деньги». По нему Сбербанк приобретает три четверти доли в уставном капитале СП за 60 миллионов долларов США.

ОШИБКА МЕСЯЦА

Мобильный музыкальный сервис Bloom.fm, инвестором которого выступал российский телеканал ТНТ, не смогл найти нового инвестора и закрылся. Сервис работал по модели подписки, схожей с тем, что предлагается на рынке Spotify и TuneInRadio. Руководство Bloom.fm объясняет отказ инвесторов от финансирования организационными изменениями в структуре самого телеканала (входит в холдинг «Газпром-Медиа»), а также финансовыми просчетами в бизнесе самого стартапа — он был убыточен из-за необходимости больших отчислений мейджорам на фоне небольшой платежеспособной пользовательской базы.

Нашли опечатку? Выделите текст и нажмите Ctrl + Enter

Материалы по теме

- 1 ABC-анализ в бизнесе: что такое, для чего нужен и как проводится

- 2 Инструменты на основе ИИ, которые помогают предотвращать травмы на производстве

- 3 Бизнес-модель open source: как зарабатывают на альтруизме

- 4 Сложная продуктовизация: как вывести разработанный программный продукт на рынок и добиться его монетизации

- 5 Адаптация рынка мобильной разработки: что изменилось за последние годы?

ВОЗМОЖНОСТИ

20 апреля 2024

21 апреля 2024

21 апреля 2024